Utah Online Sales Tax Rate . Use our calculator to determine your exact. With local taxes, the total sales tax rate is between 6.100% and 9.050%. the state sales tax rate in utah is 4.850%. 270 rows utah sales tax: For more information on sales & use taxes,. you can use our utah sales tax calculator to look up sales tax rates in utah by address / zip code. Utah has state sales tax of 4.85%, and allows local. 100 rows this page lists the various sales & use tax rates effective throughout utah. utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. The calculator will show you the. utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. Average sales tax (with local):

from forixcommerce.com

For more information on sales & use taxes,. Average sales tax (with local): Utah has state sales tax of 4.85%, and allows local. Use our calculator to determine your exact. you can use our utah sales tax calculator to look up sales tax rates in utah by address / zip code. utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. 100 rows this page lists the various sales & use tax rates effective throughout utah. the state sales tax rate in utah is 4.850%. 270 rows utah sales tax: The calculator will show you the.

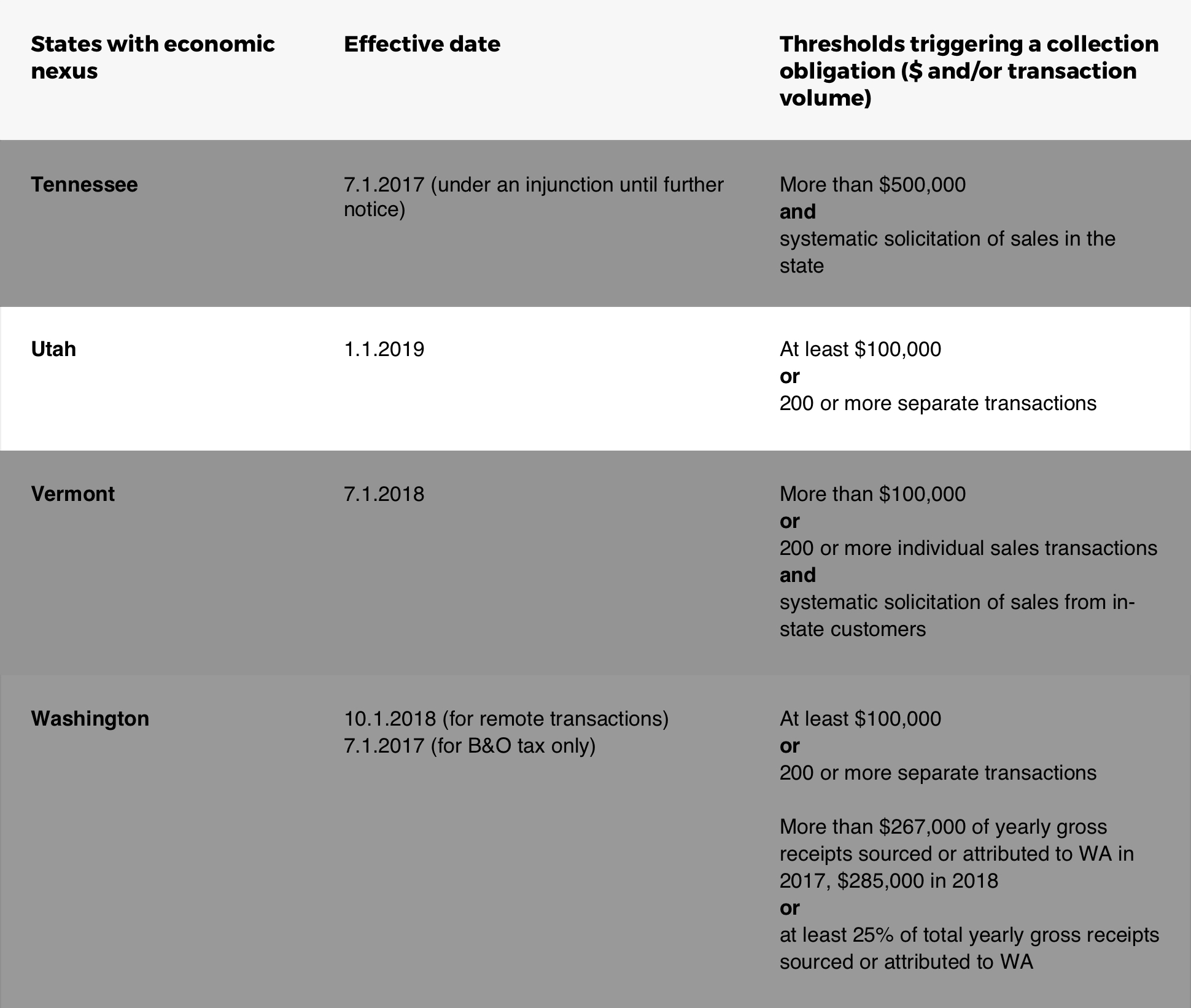

How to Interpret New Utah Online Sales Tax Rules

Utah Online Sales Tax Rate utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. The calculator will show you the. utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. the state sales tax rate in utah is 4.850%. Use our calculator to determine your exact. 100 rows this page lists the various sales & use tax rates effective throughout utah. Utah has state sales tax of 4.85%, and allows local. 270 rows utah sales tax: you can use our utah sales tax calculator to look up sales tax rates in utah by address / zip code. With local taxes, the total sales tax rate is between 6.100% and 9.050%. Average sales tax (with local): For more information on sales & use taxes,. utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote.

From utahtaxpayers.org

Utah’s Wireless Taxes Top Neighboring States and Rank 12th Highest in Utah Online Sales Tax Rate you can use our utah sales tax calculator to look up sales tax rates in utah by address / zip code. Utah has state sales tax of 4.85%, and allows local. Average sales tax (with local): utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. The calculator will show you the.. Utah Online Sales Tax Rate.

From honeyblorrayne.pages.dev

Utah Tax Rate 2024 Lotte Rhianna Utah Online Sales Tax Rate The calculator will show you the. the state sales tax rate in utah is 4.850%. Use our calculator to determine your exact. 270 rows utah sales tax: 100 rows this page lists the various sales & use tax rates effective throughout utah. Average sales tax (with local): utah requires a remote seller to collect and pay. Utah Online Sales Tax Rate.

From incometax.utah.gov

Use Tax Utah Taxes Utah Online Sales Tax Rate utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. For more information on sales & use taxes,. 100 rows this page lists the various sales & use tax rates effective throughout utah. the state sales tax rate in utah is 4.850%. Average. Utah Online Sales Tax Rate.

From heyjoahd.blogspot.com

Utah Car Sales Tax 2021 / New Cadillac Escalade Jerry Seiner Cadillac Utah Online Sales Tax Rate The calculator will show you the. With local taxes, the total sales tax rate is between 6.100% and 9.050%. the state sales tax rate in utah is 4.850%. utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. 100 rows this page lists. Utah Online Sales Tax Rate.

From salestaxusa.com

Utah Sales Tax Tax Rate Guides Sales Tax USA Utah Online Sales Tax Rate Average sales tax (with local): the state sales tax rate in utah is 4.850%. Use our calculator to determine your exact. utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. For more information on sales & use taxes,. 270 rows utah sales tax: With local taxes, the total sales tax. Utah Online Sales Tax Rate.

From taxfoundation.org

2021 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Utah Online Sales Tax Rate With local taxes, the total sales tax rate is between 6.100% and 9.050%. utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. Utah has state sales tax of 4.85%, and allows local. For more information on sales & use taxes,. 100 rows this page lists the various sales & use tax. Utah Online Sales Tax Rate.

From larainehanna.blogspot.com

pay utah sales tax online Laraine Hanna Utah Online Sales Tax Rate For more information on sales & use taxes,. 100 rows this page lists the various sales & use tax rates effective throughout utah. Use our calculator to determine your exact. 270 rows utah sales tax: Average sales tax (with local): utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. . Utah Online Sales Tax Rate.

From statetaxesnteomo.blogspot.com

State Taxes State Taxes Utah Utah Online Sales Tax Rate Average sales tax (with local): the state sales tax rate in utah is 4.850%. 100 rows this page lists the various sales & use tax rates effective throughout utah. you can use our utah sales tax calculator to look up sales tax rates in utah by address / zip code. utah requires a remote seller to. Utah Online Sales Tax Rate.

From www.formsbank.com

Fillable Form Tc71m Sales And Use Tax Return Utah State Tax Utah Online Sales Tax Rate For more information on sales & use taxes,. utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. the state sales tax rate in utah is 4.850%. utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location.. Utah Online Sales Tax Rate.

From exoxyqeqj.blob.core.windows.net

Sales Tax Rate On Cars In Utah at Donna Caceres blog Utah Online Sales Tax Rate the state sales tax rate in utah is 4.850%. 100 rows this page lists the various sales & use tax rates effective throughout utah. The calculator will show you the. utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. Utah has state. Utah Online Sales Tax Rate.

From www.washco.utah.gov

How has Washington County maintained one of the lowest tax rates in Utah Online Sales Tax Rate 270 rows utah sales tax: 100 rows this page lists the various sales & use tax rates effective throughout utah. the state sales tax rate in utah is 4.850%. utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. you can. Utah Online Sales Tax Rate.

From fr.slideshare.net

Utah sales and use tax q2 2019 example Utah Online Sales Tax Rate The calculator will show you the. 270 rows utah sales tax: utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. Use our calculator to determine your exact. Utah has state sales tax of 4.85%, and allows local. you can use our utah. Utah Online Sales Tax Rate.

From zhenhub.com

Sales Tax Rates by State 2022 Utah Online Sales Tax Rate With local taxes, the total sales tax rate is between 6.100% and 9.050%. the state sales tax rate in utah is 4.850%. you can use our utah sales tax calculator to look up sales tax rates in utah by address / zip code. 270 rows utah sales tax: utah requires a remote seller to collect and. Utah Online Sales Tax Rate.

From thetaxvalet.com

How to File and Pay Sales Tax in Utah TaxValet Utah Online Sales Tax Rate 270 rows utah sales tax: For more information on sales & use taxes,. Average sales tax (with local): you can use our utah sales tax calculator to look up sales tax rates in utah by address / zip code. utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. 100. Utah Online Sales Tax Rate.

From www.salestaxsolutions.us

Sales Tax Utah Utah Sales Tax Registration SalesTaxSolutions.US Utah Online Sales Tax Rate The calculator will show you the. Utah has state sales tax of 4.85%, and allows local. With local taxes, the total sales tax rate is between 6.100% and 9.050%. the state sales tax rate in utah is 4.850%. utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. 270 rows utah. Utah Online Sales Tax Rate.

From zamp.com

Ultimate Utah Sales Tax Guide Zamp Utah Online Sales Tax Rate the state sales tax rate in utah is 4.850%. Average sales tax (with local): utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. For more information on sales & use taxes,. The calculator will show you the. utah sales and use tax. Utah Online Sales Tax Rate.

From www.utahfoundation.org

The Everyday Tax Sales Taxation in Utah Utah Foundation Utah Online Sales Tax Rate utah sales and use tax rates in 2024 range from 4.7% to 8.7% depending on location. the state sales tax rate in utah is 4.850%. utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. 270 rows utah sales tax: The calculator. Utah Online Sales Tax Rate.

From 1stopvat.com

Utah Sales Tax Sales Tax Utah UT Sales Tax Rate Utah Online Sales Tax Rate utah requires a remote seller to collect and pay utah sales tax if, in either the previous or the current calendar year, the remote. The calculator will show you the. 100 rows this page lists the various sales & use tax rates effective throughout utah. you can use our utah sales tax calculator to look up sales. Utah Online Sales Tax Rate.